QR Codes

This specification is subject to change, it is Work in Progress. The Colombian EASPBV standard is evolving to support the capabilities of the Bre-B network. Passport is actively collaborating with industry stakeholders to shape a flexible and robust QR Code integration model for real-time payments.

Overview

QR Codes provide a streamlined mechanism for initiating payments between parties. A person may generate a QR Code to share payment details, while a merchant can display one to help a buyer complete a purchase at a point of sale (POS).

The Passport PaaS Platform enables the creation of compliant QR Codes that follow the EASPBV Colombian industry standards. These QR Codes can be used in both digital and offline channels, reducing manual errors and enhancing the buyer experience.

Bre-B QR Codes simplify the sale process by embedding essential information (e.g., merchant key, transaction amount, purpose) into a scannable format, reducing friction and improving security - saving you time.

QR Code requirements are defined by institutions including: ACH Colombia, Banco de la República, Credibanco, EMV Co, Mastercard, Redeban, Servibanca, Visa, and Visionamos.

Passport, in partnership with Visionamos, operates a national Bre-B access point to process Bre-B payments and issue QR Codes for use across the ecosystem.

Payment Lifecycle

Bre-B QR Codes can be used across physical and digital channels: including posters, POS terminals, ATMs, websites, and mobile apps.

Example: Coffee Shop Purchase

Sample Payment Lifecycle

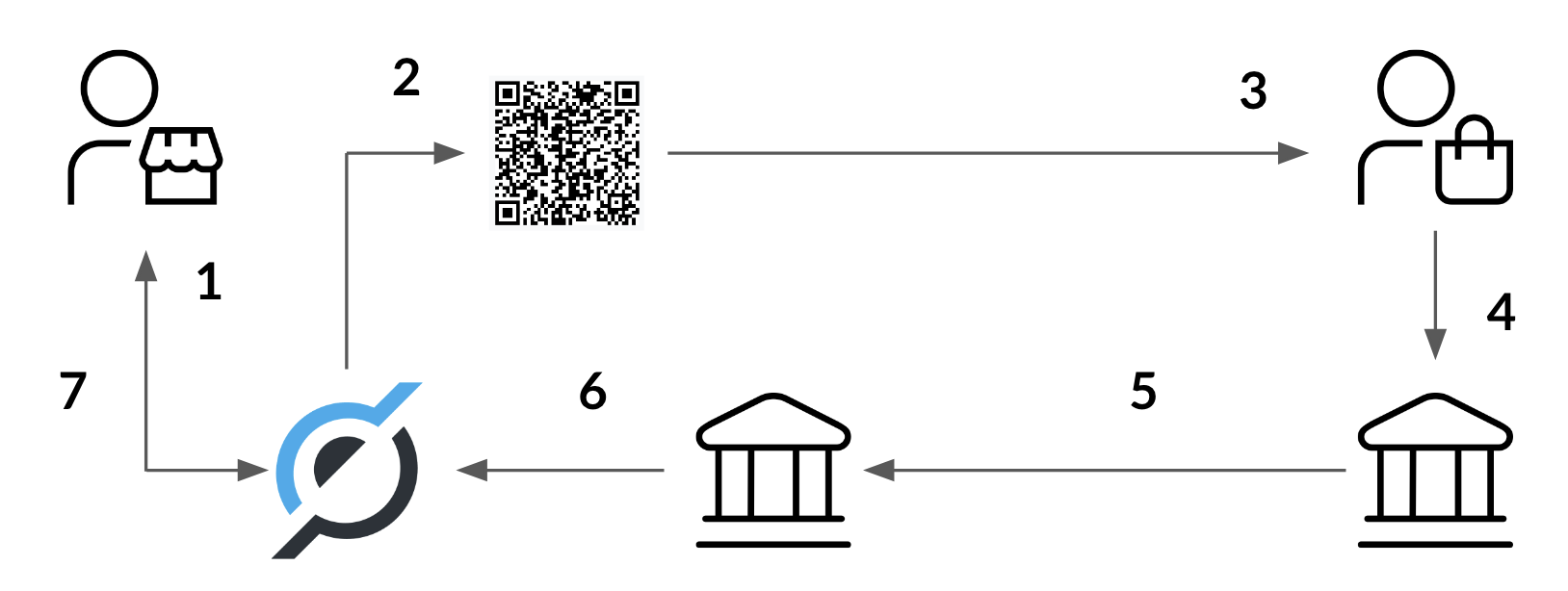

The image above depicts a simple transaction for a Buyer to purchase a coffee at a Point of Sale where the simple steps are:

- Merchant creates a sale in their POS system.

- The POS system generate a dynamic QR code using the Passport PaaS API and displays it to the Buyer.

- The Buyer scans the QR code using their mobile banking app's within the Bre-B payment zone.

- The app pre-fills the recipient (merchant key), amount, and transaction purposes.

- The Buyer reviews and confirms the transaction.

- The payment is sent via Bre-B from the Buyer's bank to Passport's sponsor bank.

- Passport PaaS receives confirmation from the Bre-B node and identifies the corresponding Merchant.

- A Webhook notification is sent to the Merchant's POS system to confirm payment.

The full cycle typically completes in under 10 seconds, providing a seamless and virtually real-time experience for both buyer and merchant.

Without QR Codes, this flow would require manually sharing and entering sensitive data, increasing the chance of errors and transaction abandonment.

Platform Capabilities

The PaaS platform allows developers to programmatically create, retrieve, and delete QR Codes via REST APIs. Once created, QR Codes cannot be modified. To change any details, the QR Code must be deleted and reissued.

| Field | Description |

|---|---|

| QR Code Type | A mandatory field to set a Static or Dynamic QR Code. Dynamic are generated for each sale at a Coffee Shop Point of Sale system. Static may be printed out on a poster and shown permanently at a Lemonade Stand. |

| Key | The Bre-B Key linked to the Merchant's account. Used to identify the recipient of funds. This will be populated within the mobile banking app of the buyer and where the funds will be sent to complete the Sale. |

| Channel | Identifies the method which the QR Code is presented to the Buyer, such as via: Point of Sale, Mobile Application, ATM, or Website. |

| Transaction Purpose | Records what the transaction is for, such as: Shopping, Transfer, Collection, Deposit or Cancellation. |

| VAT | Captures the appropriate VAT information for reporting to authorities. |

| INC | Captures the appropriate INC information for reporting to authorities. |

| Value | Required for Dynamic QR Codes as it varies for each QR Code: this field allows the Developer to set the gross amount (before any VAT or INC) to be preset for the Buyer. |

The Passport PaaS Platform combines data from the QR Code API request and the Customer resource to validate and complete all required fields.

Once submitted, the platform returns a QR Code in EMV-compliant string format, which can then be rendered visually and shared across your chosen channel.

The QR Code will be able to be read by any mobile banking application in Colombia that has implemented the Bre-B reader.

QR Codes cannot be updated once created. If you need to change any value:

Cancel the previous transaction.

Delete the QR Code.

Create a new QR Code with updated values.