Title

Create new category

Edit page index title

Edit category

Edit link

Bre-B Payment Initiation

Overview

The PaaS Platform can be used to initiate a Payment to any Bre-B participant who is also using the real time payment network. This is great method to disperse funds quickly and conveniently at a fraction cost to more traditional methods like ACH or PSE.

Intended for:

- Technical teams implementing API integrations.

- Product teams evaluating user experience.

- Business stakeholders assessing real-time payment strategies.

Payment Flows

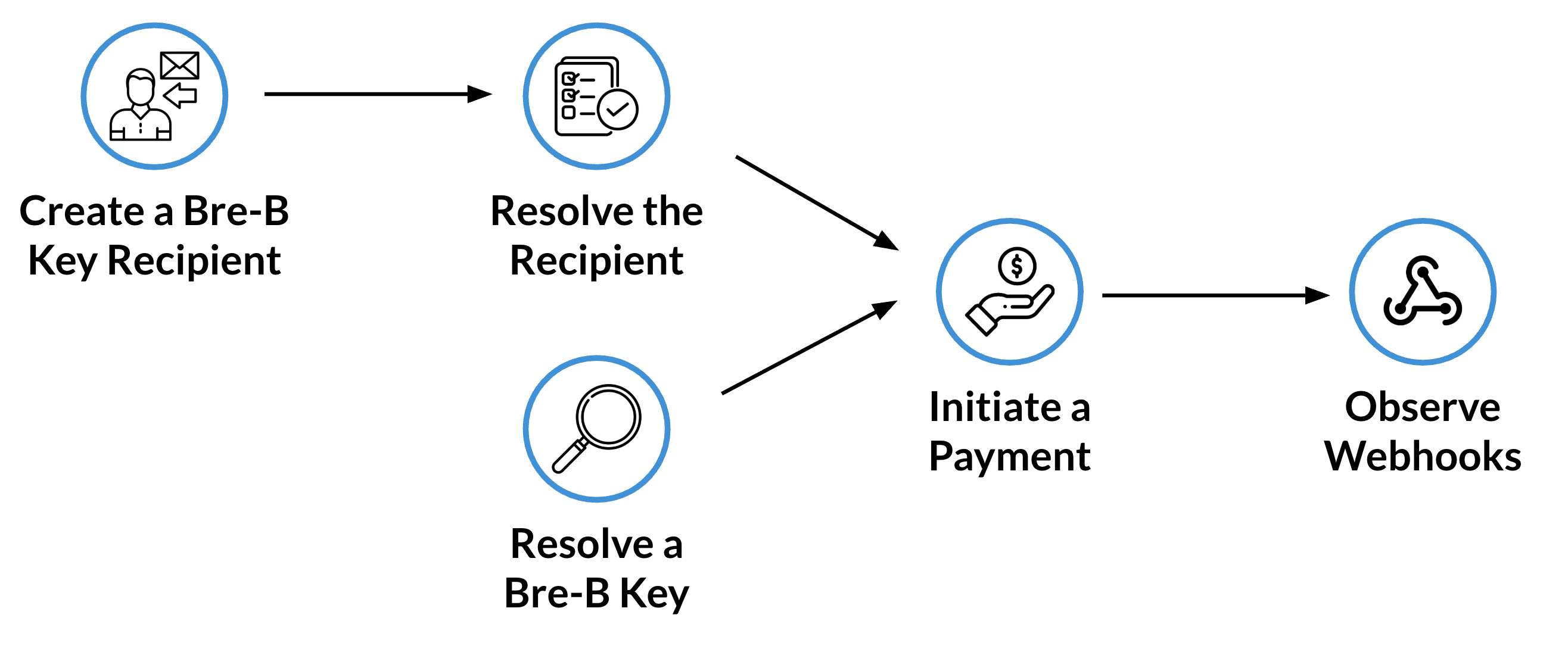

There are multiple methods to initiate a Bre-B Payment, the API calls are visualised in the flow below.

Image 1 - Payment Initiation Flow

The Bre-B Payment can either be initiated by creating a Recipient, or by resolving a Bre-B Key. Depending on the Customer experience, each can provide the same outcome but for different tasks:

- Creating a Recipient: May be useful when payments will regularly be made, such as paying rent, or for transferring money to friends and family. Each time a Payment is to be made, the Bre-B Key (or Recipient) must be resolved to ensure the Bre-B Key still represents the intended recipient of the funds.

- Resolving a Bre-B Key: Useful at one time transactions, such as making a purchase at a Point of Sale where speed and convenience is more important. This flow is typically initiated by the Customer scanning a QR Code at the Point of Sale and the Bre-B Key is extracted from that QR Code, to then commence that flow.

Both flows return the information that the Bre-B Key represents:

- Owner: Who registered the Bre-B Key.

- Account Information: The linked Bank Account where the funds will be received

- Bank: The financial entity that has the relationship with the owner and the Account.

The Owner information must be presented to the Customer in order to ensure that the intended recipient is as expected, there is a risk of funds ending up at the wrong destination if the Bre-B key is typed or shared incorrectly.

Resolving a Recipient, and Resolving a Bre-B Key, can both be used to initiate the Payment request which submits the request to the Bre-B network.

As the messages are flowing through the system, the PaaS Platform sends Webhooks notifying the sender that the payment lifecycle is progressing to, and completing, the settlement process.

Bre-B Payment Flow Steps

To successfully complete the payment flow follow the steps below:

| Step | Action | Description |

|---|---|---|

| 1 | Create Bre-B Recipient | Add a Bre-B Key as a recipient to refer to it via a unique identified for future payment requests. |

| 2a | Resolve Bre-B Recipient | This step converts the Bre-B Key into the recipient information - the key owners information, the Financial Entity and the Account information. Take the |

| 2b | Resolve a Key | Alternatively, the Platform can resolve a Key directly - such as one that has been extracted from a QR Code - for use with a Payment. Take the |

| 3 | Present Resolved Information | The Developer must present the converted information to the Customer via their Digital Channel for confirmation that the name converts into an expected value. This is an important (mandated) step from Banco de la Republica in order to ensure the Customer is not sending to the wrong intended destination. |

| 4 | Initiate Payment | Submit the resolution_id and supporting information to initiate the submission of the Payment to the Sponsor Bank for processing. |

| 5 | Webhook for Payment Confirmed | Once the receiving Financial Entity has confirmed the payment, a webhook will be shared to confirm that the happy path has completed. |

| 6 | Webhook for Payment Settled | Once funds have been moved at the Central Bank, a webhook will be shared to confirm that the funds have settled. |

Bre-B Payment Considerations

Sending money via Bre-B promises to bring many new uses cases and opportunities for the Colombian ecosystem. Below are some considerations that should be noted when designing the specific flows:

- Bre-B Keys can be deleted and reregistered with a new Recipient in less than 20 seconds, consider that when designing the Payment flow.

- Keys (Recipients) should always be resolved to convert the Bre-B key into the Owner information, there is no limit to porting keys between Financial Entities so the owner could change unknowingly.

- Keys can be deleted, and recreated, with no delay so within 20 seconds (10 seconds for deletion, 10 seconds for recreation), the expected

Ownerof theKeycould change. - Payments are expected to settle within 45 seconds, however there are allowances to take minutes to settle.

- Once in the

ACCEPTEDstate, the Payment has been accepted at the destination Financial Entity and the Payment could be deemed to be completed, for those situations where speed is important to the Customer experience. - Once in the

SETTLEDstate, funds have changed hands between the Financial Entities at the Banco de la República, this is anticipated to be at most, 7 seconds after the payment has been accepted. - Only once the Payment is in the

SETTLEDstate can the Payment be considered as final, while unlikely. - Key (Recipient) Resolution is subject to a fair use policy to prevent spamming of all the potential Keys in the ecosystem.

- There is no limit on creating Recipients on the system.

- Review the Error Codes for potential causes of failures and returns.