Title

Create new category

Edit page index title

Edit category

Edit link

QR Code Payment Lifecycle

Introduction

A common method to facilitate inbound payments are those made through a QR Code within the Bre-B ecosystem in Colombia.

The expected flow includes the point-of-sale (POS) system connecting with the Passport PaaS platform, the Bre-B Node, and the participating financial institutions. Throughout this page, the POS is assumed to be the backend system that connects to the Passport Platform but there could be a number of variations - the flows will remain the same.

Intended for:

- Technical teams implementing API integrations.

- Product teams evaluating the user experience.

- Business stakeholders analyzing real-time payment strategies.

Flow Overview

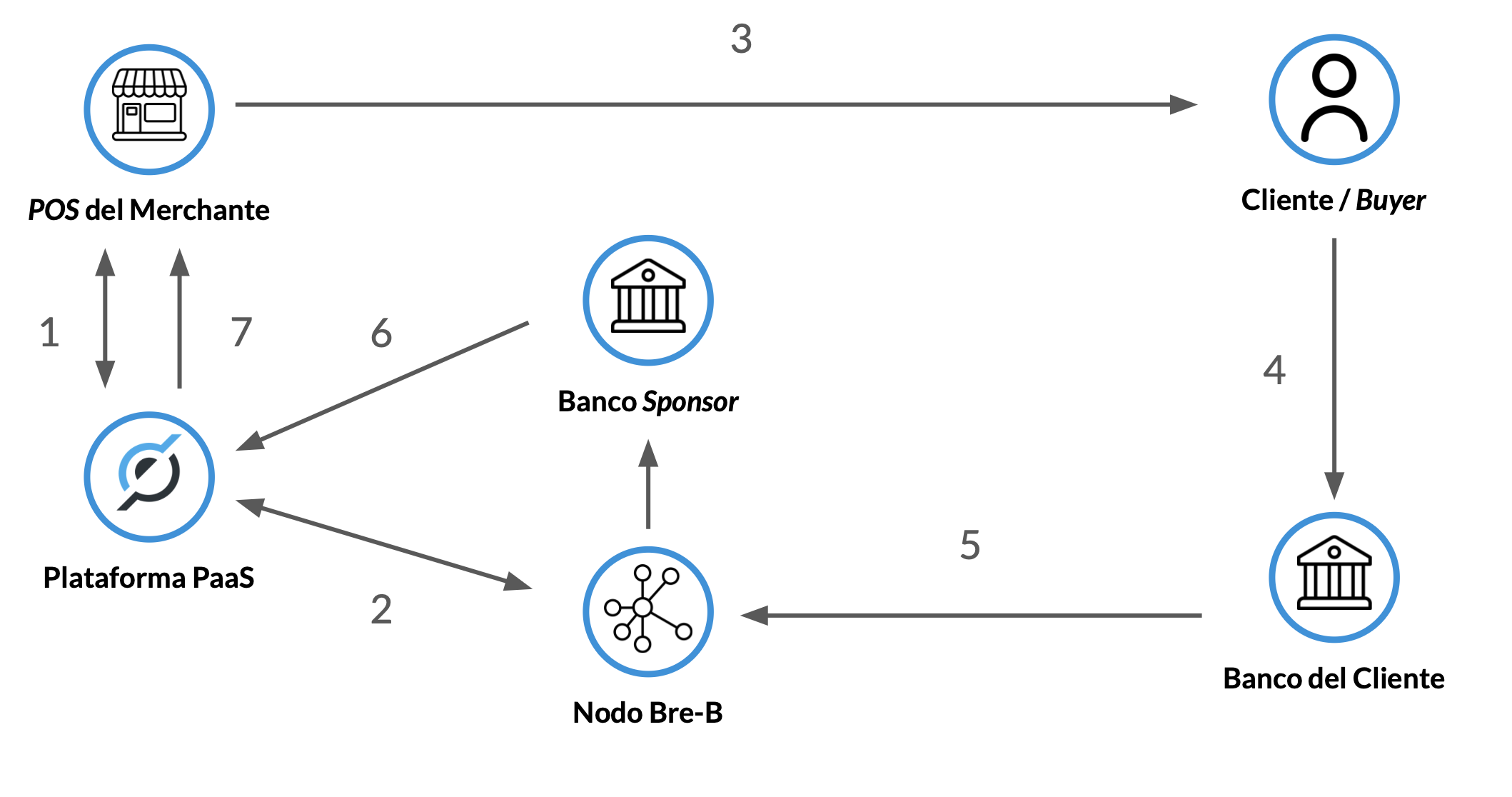

The following image summarizes the steps from the QR Code generation request to the confirmation of the payment via Webhook to the merchant.

Transaction Flow Diagram

QR Code Payment Steps

| Step | Action | From | To |

|---|---|---|---|

| 1 | QR Code Request | POS | PaaS Platform |

| 2 | QR Code Generation | PaaS Platform | Bre-B Node |

| 3 | QR Presentation to Customer | POS | Buyer |

| 4 | Payment Initiation | Buyer | Customer’s Bank |

| 5 | Payment Routing | Customer’s Bank | Bre-B Node → Sponsor Bank |

| 6 | Credit Notification | Sponsor Bank | PaaS Platform |

| 7 | Webhook Confirmation | PaaS Platform | POS |

Flow Description

The PaaS Platform does not automatically connect to the POS system; it is the responsibility of the fintech or provider to establish this integration.

Step 1: QR Code Creation Request

The merchant’s POS system requests the PaaS Platform to generate a Dynamic QR Code for a new payment session.

The creation of the QR Code should (or could) include a qr_code_reference that can be used to track the transaction across the entire Payment lifecyle. This links the QR Code to the pending sale on the POS system (or a pending deposit in a fintech app) and can be received within the Inbound Payment Notification.

Step 2: QR Code Generation

The PaaS Platform generates the QR Code, which includes a unique Bre-B key and associated payment metadata.

This aligns with the latest specification for QR Codes in Colombia as determined by the EMV Co and a volunteer body made up of ACH Colombia, Credibanco, Redeban, Visionamos, Mastercard and Visa.

Step 3: QR Presentation to Customer

The generated QR Code is displayed on the POS for the buyer to scan using the Bre-B Zone of their mobile banking application.

Each Financial Entity in Colombia is mandated to support QR Code scanning via the Bre-B Zone - it assures consistent functionality across any entity wishing to participate in the payment network.

Step 4: Payment Initiation

The Financial Entity application extracts the information from the QR Code and then prepares to initiate the Payment. The initiation process must follow set steps and each Financial Entity is certified that they can follow appropriately.

These steps will include extracting, amongst other information the qr_code_reference that was set in step 1 by the POS system. This information is passed into the Payment message as the Financial Entity initiates the debit from the buyer’s account.

Step 5: Payment Routing

The buyers Financial Entity routes the payment through the Bre-B Node that they are connected to, which forwards it through the Banco de la República and on to the Node that forwards to the Merchant’s Sponsor Bank.

Step 6: Credit Notification

The Sponsor Bank reviews the inbound payment against any AML policies, checks that the Account and intended receiver exists, before crediting the Merchant’s Bank Account.

The PaaS Platform is monitoring both the Bre-B Node connection as well as the Merchant Bank Account so when the inbound payment notification is received, it is also aware.

Step 7: Webhook Confirmation

The PaaS Platform sends a Webhook to the Merchant POS system confirming that the payment has been received, allowing the transaction to be completed.

The Inbound Payment Webhook contains the qr_code_reference that was created in Step 1 by the POS, that was extracted in Step 4 and passed through the Bre-B Network in Steps 5 and 6.

This ensures the inbound Payment can be properly identified and mapped against the pending Sale on the POS system (or pending deposit in a fintech platform).

The Banco de la República has mandated that all Financial Entities support QR Code activities (creation, scanning, payment routing) however we have seen inconsistent implementations of the specification during the early stages of the Bre-B service.

It is recommended to, where possible, have a backup process for identifying inbound payments in case the buyers Bank is not operating in a compliant manner. The page, Receiving a Bre-B Payment contains ideas of how to mitigate such a scenario.

QR Code Validation

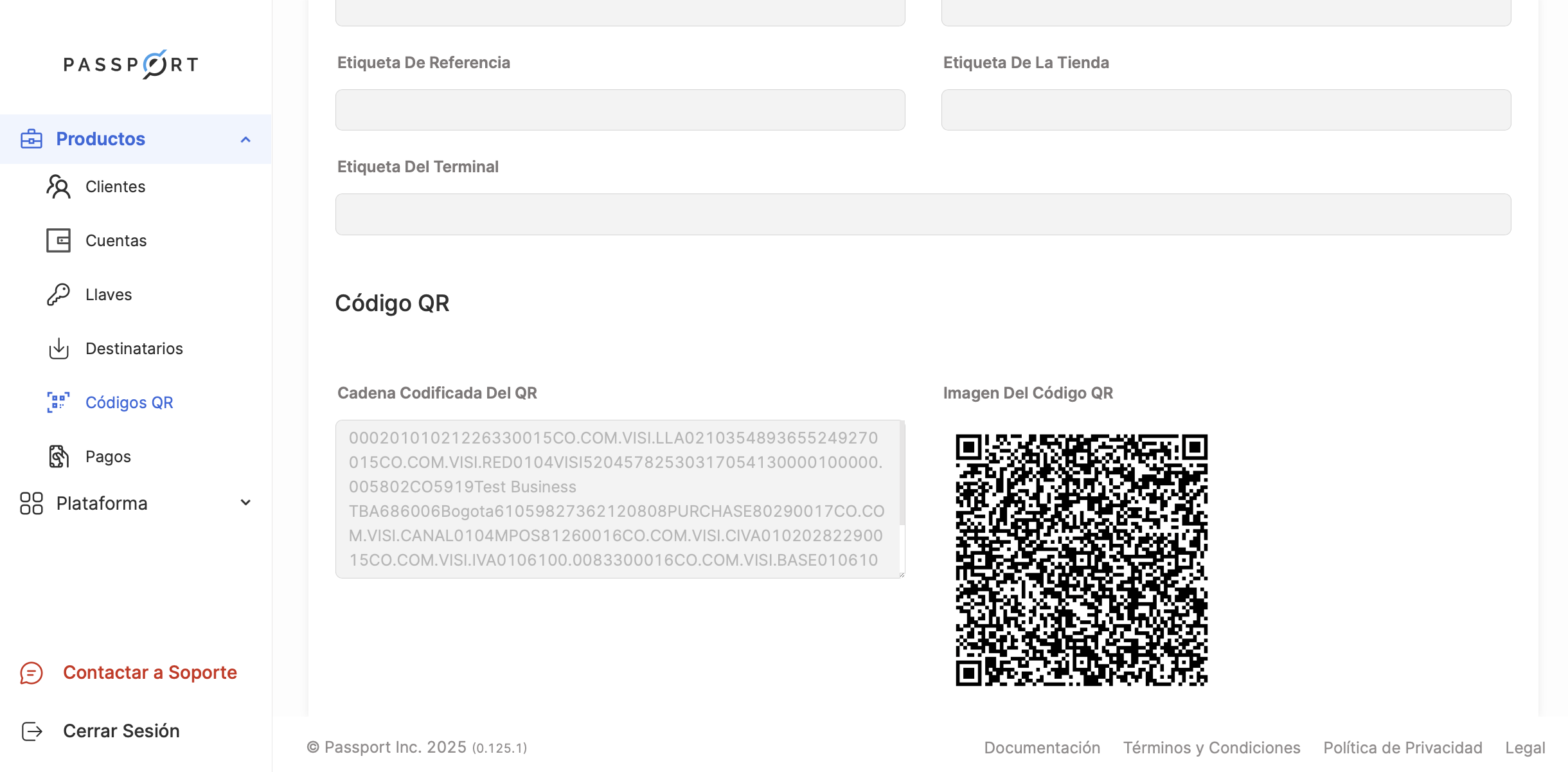

Passport provides, in the Products > QR Codes section, a history of all generated QR Codes.

For each one, you can:

- View the image converted from base64 format.

- Use any QR code reader to validate the encoded information.

- For more details, refer to the QR Codes document.

Example of a QR Code